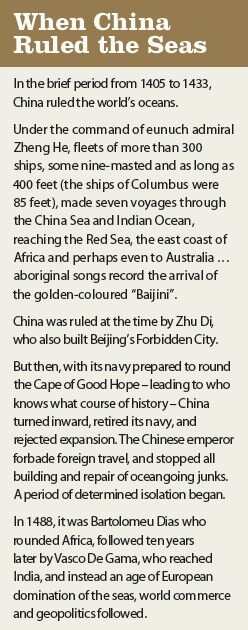

China ruled the seas in the 15th century, only to withdraw in isolation. Now, the gates are open to Hawke’s Bay traders.

In the past 12 months, CEO Robert Darroch of Napier’s Future Products Group (FPG) has spent about 20 working days in China. He started doing business in China in 2006.

Darroch easily qualifies as one of Hawke’s Bay’s most astute China business practitioners. Does he know the ropes yet? “The more you go, the less you know”, he replies. “The only ones who are successful are the ones who have made more mistakes than the others.”

Lawrence Yule has made 18 visits to China during his mayoral tenure, including two so far this year. He’s totally hooked on our China trading potential.

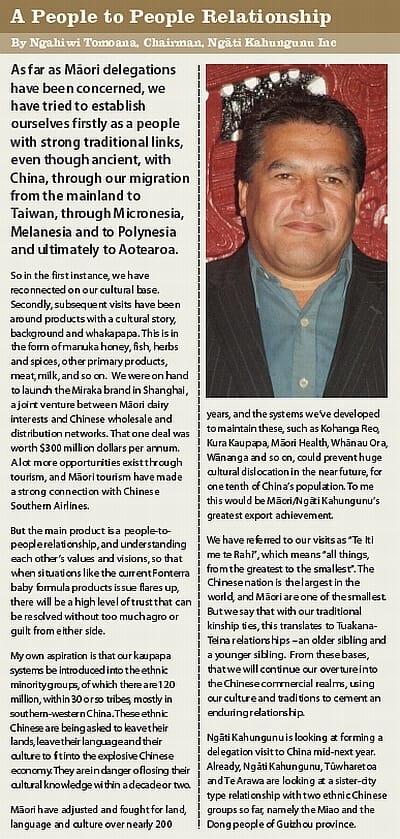

Ngahiwi Tomoana, chairman of Ngäti Kahungunu Inc has made ten relationship-building trips to China over the last three years, and has hosted six Chinese delegations in that time. His China agenda is even more ambitious.

And these veterans are joined by a small but growing band of Hawke’s Bay-to-China road warriors, slowly gaining a toehold in that vast market.

The spurt in New Zealand’s trade with China began with the signing of the Free Trade Agreement (FTA) between the two nations in 2008. Today’s exports to China are valued at $5.8 billion, with $1billion growth for each of the last four years.

By 2019, 96% of NZ exports to China will be tariff free. Importantly, this was the first FTA China had signed with any developed country. As such, the agreement carries huge political symbolic significance in China.

And in China, where political favour leads, commerce follows. The higher the stakes, the more desperate the currying of political favour. Indeed, the NY Times recently reported in an article titled, Many Wall St. Banks Woo Children of Chinese Leaders, “bankers and lawyers said the practice of hiring the children of government officials was so widespread that banks competed to see who could hire the most politically connected recent college graduates.”

That’s the extreme. However, to a person, every Hawke’s Bay exporter to China stresses that building personal relationships, while important to doing business in any situation, is vitally important with their Chinese associates.

Asked about key ingredients for being successful in China, Export NZ’s Amanda Liddle replied: “Relationships. Relationships. Relationships. Don’t just go over, set up your distribution channel then leave it to the agent or whoever is working for you to run. You need to keep going back, visiting you customers and understanding the market.”

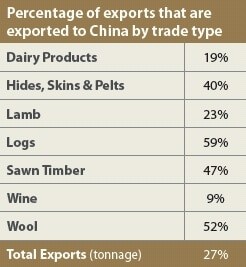

HB Exports to China

It’s frustratingly difficult to get one’s arms around the scope and size of Hawke’s Bay’s trade to China today (this article is focused on our exports only). Overall, our export volume through Napier Port (all destinations) is about 3 million tonnes per year; 27% of that goes to China.

However, businesses are reluctant to disclose commercial information, and government data is not broken down by regions.

Our chief categories of traded goods to China present no surprise – logs and timber products, lamb and wool, hides etc, and wine. Trade types not in the adjacent table are inconsequential in current volume.

The HB companies establishing our China presence include more familiar names like Ovation, Progressive, Apollo Apples, numerous winemakers, and less familiar companies like CSI Foods (processed veggies) and Darroch’s FPG. The consensus amongst those interviewed is that fewer than 100 Hawke’s Bay companies are presently trading in China.

A major project of Business Hawke’s Bay (BHB), aimed at identifying Hawke’s Bay’s ‘export ready’ companies, and within that group, those pointing toward China, has been delayed awaiting the appointment (recently made) of Business HB’s new chief executive, Susan White.

White says “international trade development including China is a high priority” and adds: “The goal for the China trade development project is fundamentally about supporting and accelerating market entry for those businesses who aspire for growth from China, or indeed other international markets.

The theory is straightforward: identify interest and ‘export-readiness’ amongst potential Hawke’s Bay exporters to China, assist with building their trading know-how, identify collaboration opportunities, help make introductions into the market.

In practice, not so easy. As one experienced China trader said: “Many Hawke’s Bay companies would have difficulty exporting to the South Island, let alone China.” Without exception, practitioners BayBuzz interviewed stressed the complexities of getting started in the vast and culturally unfamiliar China market. Most agreed that China was not the market where an eager new exporter should lose their exporting virginity.

Robert Darroch, whose FPG Shanghai has earned ‘foreign-owned enterprise’ status in China, notes that even with a Chinese manager on the ground it took his company three years to sort out its supply chain, and as long to gain access to the lower ‘China price’ (as opposed to the price charged outsiders) on goods and services. His 25 employees at FPG Shanghai manufacture food display cabinetry.

So at the moment, no one really knows what the overall exporting potential of Hawke’s Bay businesses might be, let alone the China-focused component.

And while there is steadily increasing collaboration amongst local councils, NZ Trade & Enterprise (NZTE), Export NZ, Business HB, the Chamber, EIT, as well as individual companies, there is presently no overall ‘China strategy’ for Hawke’s Bay.

But help is available. NZTE is best positioned to make introductions and provide guidance to HB exporters seeking to enter the China market. Several current practitioners cite NZTE’s ‘NZ Central’ in Shanghai as an excellent facility – conference rooms, office support, even a barbeque terrace – which Kiwi businesspeople can use as a hub to meet and entertain potential Chinese partners. Groups like NZTE and Export NZ routinely provide informational and training workshops and networking forums, but often these efforts are mostly focused on the largest companies.

Wine sector ambitions

Nothing Hawke’s Bay might export will dent the vast Chinese market in terms of volume. That said, for commodity products like logs and lamb, the Chinese can swallow everything we can provide. Mayor Yule notes that in five years China has become Hawke’s Bay’s largest market for lamb, starting from zero.

Instead of volume, most Hawke’s Bay exporters to China will emphasize premium quality. Our wine sector is perhaps the best illustration. Although wine is NZ’s ninth ranked global export, it is not yet in the top 20 exports to China.

Te Mata Estate first entered the China market in 2001. Today China is Te Mata’s second highest export market, and will soon be #1. China is #1 for Ngatarawa and Trinity Hill as well.

What are these successful wine merchants selling to China? Superior red wines … red wines, with which Hawke’s Bay excels.

Wine drinking in China is largely a prestige-linked behaviour – occurring in public in official, business and social settings, and often involving gifting – and the perception in China is that the prestige wines are red. Plus red wine, with its tannins, is much more suited to Chinese tastes and perceived as healthy. Consequently, Chinese wine consumption is dominated by reds, as much as 80% of the market.

Voila! Hawke’s Bay’s red winemakers have exactly the right product for the market. Says HB Winegrowers Chairman Nicholas Buck, by 2014 China will be taking 1 in every 2 bottles of exported NZ cabernets/merlot, and Hawke’s Bay produces approximately 85% of NZ’s cabernets and merlots.

Winemakers in the region recognize the opportunity, and twenty or so have begun to plan greater collaboration to promote Hawke’s Bay reds in China. By Michael Henley’s (Trinity Hill) estimate, about 3,000 hectares of prime red wine grapes are planted in Hawke’s Bay’s best soils, which might yield 24,000 tones of premium grapes, producing 1.8 million cases of high value reds … more and more of them China bound.

“No wonder”, says Buck, “that we are seeing producers of Hawke’s Bay wine travelling to China, opening offices in China, developing Chinese joint venture partnerships, expanding their Hawke’s Bay production base, and engaging more closely with New Zealand’s Chinese business community.”

With a 50 million person upper class wine market to target, it would appear the sky is the limit.

HB’s trading advantages

As the story of HB’s reds illustrates, there’s no marketing advantage greater than having exactly the product specific consumers are demanding.

But Hawke’s Bay has two other trading advantages.

First, the political involvement of Hawke’s Bay’s councils with China is a valuable string on the bow. Jim Poppelwell, who after ten years in China runs a China-focused business consultancy, credits HDC “as the most active council in the China space.”

“Mayors are huge!” says road warrior Lawrence Yule. He observes that a New Zealand mayor representing a few thousand people will be treated as a peer by a Chinese host mayor who represents several million. Political introductions for Hawke’s Bay companies from mayor to mayor “effectively create a permit to do business”, especially in cases where prior relationships do not exist.

Behind the scenes, council economic development staff, mainly Steve Breen, forward the leads that arise from city relationships to appropriate Hawke’s Bay companies for them to determine if worth pursuing on a company-specific or industry basis. HDC is pushing for a regional strategy, including support for the ‘market-readiness’ project of Business Hawke’s Bay.

Indeed, for all the China enthusiasm that our councils show (including their ‘sister city’ exchanges), some argue that what is needed is a more pro-active and strategic approach from councils, with resources directed accordingly, rather than ad hoc reacting to each seemingly promising new door knock.

Yule would like to see the day when Hawke’s Bay can provision a Chinese-speaking business guide here in the Bay to assist local businesses aiming to export.

[To say nothing of assisting in-bound interest. One China hand asks: “If I represent a Chinese business or investor and am interested in exploring opportunities in the region, who do I talk to? What if I’m more comfortable communicating in Chinese?”]

Secondly, on a broader level, Brand New Zealand offers a valuable platform that Hawke’s Bay, as a significant food producer, is especially well-positioned to leverage. Several interviewees commented in various ways: “The Chinese simply like us and our country.” Beyond that, New Zealand means green, authentic and, when it comes to food, safe and premium.

As Robert Darroch puts it: “If your product goes in the mouth or on the skin, then Brand New Zealand is very important.” But in every case, he says, “They want the real thing.”

Correspondingly, the NZ reputation damage stemming from our recent series of food contamination scares would more likely be threatening to food producers than those exporting logs or hides or wool.

As several traders said to BayBuzz, as attractive and important as China is as a market, it wouldn’t be prudent to put all one’s export eggs in one basket. An action taken by a single Chinese official just to make a point about suspicious meat or dairy products could be devastating to a HB exporter. And others note that for all the same reasons Hawke’s Bay is interested in China, the rest of the world is as well, and most of our competitors are better financed.

Still, Lawrence Yule reflects the prevailing sentiment amongst HB’s China hands: “We have an exciting prospect to export to China. They are looking for quality food products in droves … Hawke’s Bay has things the Chinese people want.”