[As published in May/June BayBuzz magazine.]

The world has woken up to the fragility of many of the systems we take for granted. This ranges from our recent experiences with supply chain bottlenecks and shortages, air travel, inflationary pressures, pandemic-related illness, labour shortages and energy supply worries. So, while we are currently in the green-energy rush, with the spotlight on renewable energy, it’s been an interesting time in energy to say the least.

Rewinding to April 2020, global lockdowns triggered a collapse in demand for oil that saw storage costs hit all-time highs as producers scrambled to slow down oil production. Fast forward two years later, the world experienced an energy supply scare triggered by Russia invading Ukraine which highlighted many years of under investment with electricity, natural gas, and crude oil prices skyrocketed to spikes above US$120.

Russia’s invasion of Ukraine was not the only factor to trigger this spike. In the last 5-10 years as countries have rushed to implement carbon emission reduction targets, there has been less investment in new oil and gas supply. Some banks have limited, or even stopped, lending to fossil fuel initiatives forcing a greater reliance on energy from non-western (often state-backed) firms.

Though a fossil fuel, natural gas will have a place in the energy mix. It is viewed as a transition fuel because it can easily be turned on at peak electricity consumption times, and it emits half the carbon dioxide of coal or diesel.

Heavy industry areas are likely to increase their demand notably in the shipping industry, which is facing increased regulations and guidelines to install scrubbers or upgrade fleets to run on natural gas.

However, it’s a different story in renewable energy.

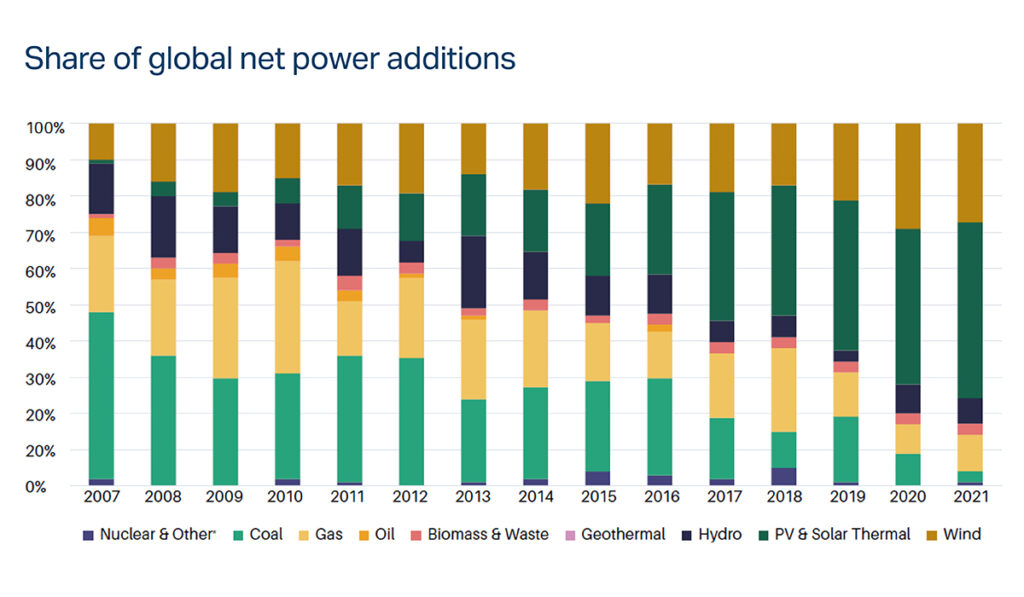

Wind and solar account for more than 10% of the world’s electricity generation, up from 2.8% a decade ago. Even more impressive is that 78% of 2021’s extra electricity generation came from solar and wind.

Both are benefitting from reductions in production costs and soaring uptake. Technology innovation is delivering impressive improvements in efficiency and in solar, ‘per watt-hour’ costs have dropped by 21% per year for the last 12 years. It’s a similar story for wind generation – down over 11% per year over the same period.

Uptake in solar has come from more homeowners adding solar panels and an increase in large-scale utility projects. There have been efficiencies created in large wind utility projects thanks to the use of bigger turbines or installing them offshore in high wind areas.

The issue with solar and wind generation is that you need the sun and wind to do their bit. The key outtake here is that the sector is getting better at finding workarounds for this. Smart energy systems charge batteries in electric vehicles (EVs) during the off-peak rate periods or using heat pumps when electricity is in plentiful supply.

From an investment point of view, it’s worth noting there are some interesting decarbonisation technologies emerging including carbon capture and storage.

Decarbonisation incorporates all the measures taken by businesses, governments, organisations, and households to reduce the level of greenhouse gas (primarily carbon dioxide and methane) emissions into the atmosphere.

Some interesting emerging decarbonisation technologies include carbon capture and storage solutions which actively take carbon dioxide out of the atmosphere. However, many of these are early-stage developments and require favourable subsidies to ensure the technology is viable when scaled up.

The shift from internal combustion engines to electric vehicles, hybrids and plug-in hybrids is an active decarbonisation effort.

Keep in mind that amongst all of this, consumer demand for energy has never been higher. With the cost of energy declining and the impressive growth in renewables, we are using more electricity and for things like EVs, heat pumps, and buildings.

Jeremy Ward is Director, Wealth Management Research at Jarden. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Securities Limited is an NZX Firm. A financial advice provider disclosure statement is available free of charge at https://www.jarden.co.nz/our-services/wealthmanagement/financial-advice-provider-disclosure-statement

The problem is that fossil fuels still make up around 80% of primary energy consumption (https://ourworldindata.org/grapher/global-energy-substitution), the energy return on energy invested ( EROEI) is rising and renewables cannot replace all of that, so we are going to have to adapt to having less available energy to do things with.