[As published in July/August BayBuzz magazine.]

The New Zealand Emissions Trading Scheme (ETS) is a key tool for meeting New Zealand’s domestic and international climate change targets. It establishes a trading market of New Zealand Units (NZU). NZUs can be traded by participating businesses through the scheme. Under the New Zealand ETS one tonne of carbon dioxide equates to an NZU. Therefore, when we talk about the carbon price in New Zealand, we are in fact referring to the price of an NZU.

The carbon price in New Zealand is, at the time of writing, $62.50 per tonne of carbon dioxide. We believe that a much higher carbon price is needed to shift our economy from its reliance on fossil fuels.

Where does that price need to be? The OECD, in its annual report on Effective Carbon Rates, suggests we need to be well north of $150/tonne of carbon dioxide by 2030 if net carbon emissions are to be zero by 2050.

Consequently, it’s puzzling why the Government did not accept the advice from the Climate Change Commission (CCC) last year calling for a much higher carbon price and a reduction in the volume of carbon units it provides.

We are of the opinion, the reason for this is simple; based on Treasury analysis the Government was concerned about the impact a higher carbon price might have on inflation, which remains stubbornly high.

Climate Change Commission advice

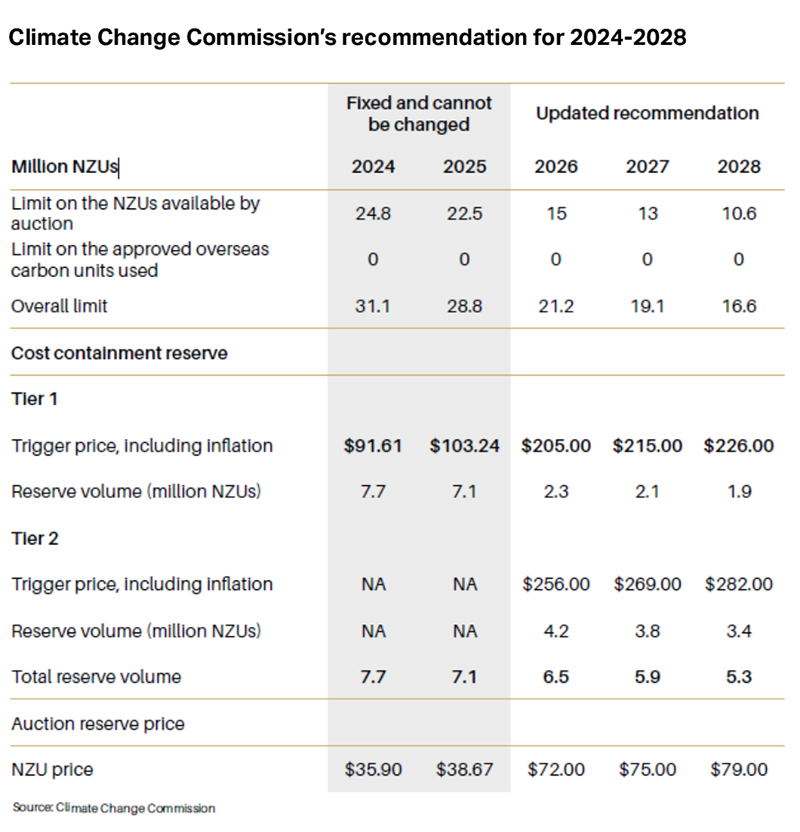

The CCC, in its latest report titled “NZ (ETS) unit limits and price control settings for 2024-2028” hasn’t stepped away from its 2022 advice to the Government and has recommended more decisive action from 2026.

They have been quite explicit since 2021 that the current ETS structure may hinder the country’s ability to achieve our carbon emission targets in the years ahead – namely, the ETS budgets, the Paris Agreement goal and the Net Zero 2050 goal.

If the ETS is to be a significant contributor to that goal and remain the country’s central mechanism for dealing with climate change, then it needs to be given room.

Why wait until 2026 to bring in these significant changes? The annual advice the CCC gives the Government about NZU limits, and NZU price control settings is a rolling 5-year outlook. Under the Climate Change Response Act they cannot recommend changes to the first two years unless extenuating circumstances exist.

This is why, in our opinion the CCC wants New Zealand to take an aggressive trajectory from 2026 onwards to meet its objective. Currently, the floor on NZU auction prices is around

$36, whereas the Cost Containment Reserve (CCR), where the government provides extra NZUs if needed, is around $91.

Starting in 2026, the CCC has recommended a significant reduction in the auction volume of NZUs it supplies to the market, raising the NZU auction reserve price to $72 and having a split CCR starting at $205 and then $256.

Carbon farming

Another problem the Government faces is potentially having too many NZUs generated by carbon farming, the planting of forests for the sole purpose of generating NZUs.

This has been well signalled in recent years. The agricultural community had expressed concerns that too much productive farmland was being changed to forestry, negatively impacting rural communities.

The reason for the change to forestry is purely economic – the return per hectare on land planted with pine to produce NZUs is multiple times what beef and sheep farming could earn from the same land.

Farmers are not alone in that concern. The CCC noted there has been a 69% increase of post-1989 forestry registered in the ETS. This creates a risk of NZU oversupply and a risk that emitters within the ETS buy NZUs to account for their carbon emissions rather than reduce carbon emissions, which is the end goal. We must reduce emissions, not offset them.

The Government has announced a review of the ETS so that it can cut gross carbon emissions while not incentivising more tree planting. That won’t be easy, but they may restrict the amount of forestry going into the ETS or restrict the amount of NZU’s forestry carbon emitters can buy versus the NZUs supplied by the government. In any event we expect changes to the ETS and higher carbon prices.

NZU price collapse – An opportunity?

Since the Government did not accept the CCC advice in December last year, the NZU price had its most significant price fall in its 15-year history, falling 40% from its $88 top to a low of $53. This fall was exacerbated by the annual seasonal selling from small forest owners who receive NZUs in the March quarter and typically sell them immediately. In previous years, demand from carbon emitters has absorbed that supply, but this year that demand failed to materialise.

However, recently the NZU price has recovered and, at the time of writing, had rallied almost 20% to $62.50 following the Government announcement on the ETS review and the recent CCC advice.

The reality is in the future a shortfall in the supply of NZUs needed to meet these new emission budgets is likely. New Zealand’s carbon emissions are stubbornly high and have not reduced materially. This needs to change to meet our domestic and international targets.

NZUs appear cheap, being nowhere near where they need to be for the economy to decarbonise.

Investors can get exposure to the NZU price by investing in the Carbon Fund (CO2) which is listed on the New Zealand stock exchange.

Nigel Brunel is Head of Commodities at Jarden. The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Securities Limited is an NZX Firm. A financial advice provider disclosure statement is available free of charge at https://www.jarden.co.nz/our-services/wealthmanagement/financial-advice-provider-disclosure-statement