The Hawke’s Bay Power Consumers Trust … what’s that?

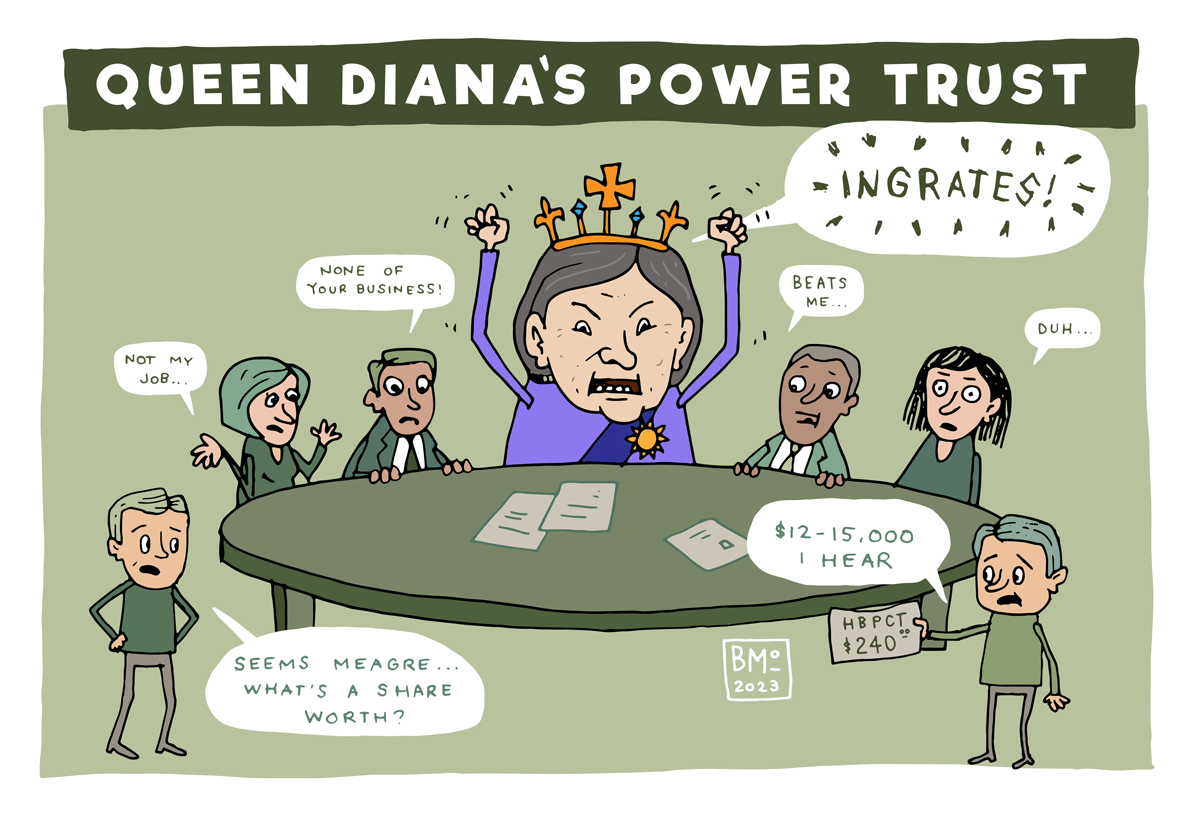

Most of us have no expectations whatsoever of the Trust, except the fervent hope that we’ll get a dollop of extra spending cash each year ($240 this year) … something to do with a benevolent dividend from Unison. Along with a smiling photo of the Trustees.

The notion that they might be more vigilant on our behalf or, alternatively, an unnecessary showpiece – or horrors, that $240 isn’t good enough – won’t occur to most people. Which is the way the Trust likes it.

So now we sit in the midst of an ‘ownership’ review of Unison – should we leave our shares (yes, yours and mine) in the hands of the Trust, where they now sit, or would alternative ownership arrangements better benefit both Unison and us, the ultimate beneficiaries.

The ownership review, despite the efforts of a variety of critics, is a pro forma exercise. Same options, same pros and cons. Yawn.

At each five-year review, Unison directors ask the same accounting firm as last time, PwC, to provide a fresh ‘independent’ assessment of Unison’s performance. The theory is that if Unison is performing OK (and they appear to be), there’s no need to mess with the status quo. Or to insist on more, as in build back better.

And Unison’s directors have little incentive to encourage any ownership structure that might place more intense scrutiny upon their stewardship of the company. Or as the directors put it in their report: “From the Company’s perspective, the Directors consider that what the Company needs as an owner of long-life intergenerational assets, alongside access to capital, is a stable shareholder (italics added) able to understand and support the intrinsic strategic value of the assets to the communities they serve.”

Unfortunately, that’s not an approach calculated to inform current shareholders of what the actual value of their (again, yours and mine) shares might be.

Indeed, astonishingly and arrogantly, Trust Chair Diana Kirton finds the entire question of what Unison shares might be worth as irrelevant … effectively none of the business of us shareholders. This despite the fact that knowledgeable insiders place that value in the $12,000 to $15,000 range, built upon an asset base of $990 million.

But since no one has been asked in the review to officially estimate that value, nor should they be asked to so long as Kirton reigns, the palace line is simply to dismiss these estimates as ungrounded and unrelated to the ownership issue.

That’s preposterous.

So, I’m making a submission to the official review and urge you to do so as well … but you only have until this coming Monday the 16th. You can submit by email here.

I’ve read all the pertinent material – Unison’s Annual Report and Asset Plan, the Unison directors’ ownership report and the PwC report prepared for them. But after all that verbiage, I will boil my submission down to:

- The Trust itself is a waste of money and offers no substantive value to Unison’s corporate leadership or to us ultimate shareholders.

- The optimum ownership arrangement is one that ensures: a) Unison’s feet are kept to the fire as it seeks to deliver first-rate services and dependable sustainable shareholder value; and b) Unison is best able to meet its burgeoning capital investment requirements.

- Whether or not the Trust so wishes, it is incumbent upon Unison’s corporate directors to explicitly and routinely examine alternative ownership structures that might potentially benefit the business.

On the second point above, I’m told that even as Unison’s capital requirements reach and exceed $100 million per year, its access to such capital is not presently constricted. There is no present need to ‘unlock’ the full market value that exists, as was successfully done with Napier Port. The directors say that they can meet near-term needs by borrowing or selling unregulated assets.

PwC says: “…future growth in shareholder value may be constrained under the current ownership model. Unexpected changes to the regulatory settings or higher than anticipated demand for network or subsidiary investment are factors which could use up available borrowing headroom and create funding constraints.”

Yet already today, as I read Unison’s latest asset and risk management plan, clearly projects have been placed on the backburner that might have spared HB residents some of the power loss pain of the recent cyclone. Similarly, at what pace should investments be made to meet the region’s and nation’s electrification goals to address climate change, or to lessen rural residents’ dependence on the connected grid? Faster than Unison now contemplates?

For us beneficiaries, the Trust initiated no review of Unison’s preparedness for the cyclone disaster or report on lessons learnt. It merely issued a media release applauding Unison’s on-the-ground disaster response, which indeed deserved praise.

One might think these are matters that an ‘oversight’ body like the Power Trust might explore with insight and gusto. Perhaps Chair Kirton does so over cups of tea with Phil Hocquard, the Unison chair. Somehow, I doubt it. Maybe the Trust board members dive into these issues at their monthly meetings; unfortunately there are no publicly available meeting minutes to enlighten us.

It’s also been noted to me that Unison could always selloff one or another of its non-regulated businesses if it became capital needy. The public, which thinks of Unison as simply the ‘lines’ company (to your home or business), is largely ignorant of this part of the company’s portfolio … and the part that has open-ended profit potential, unlike the regulated lines business.

For those of you concerned about Unison shares being ‘sold out from under you’ if, for example, the company went into the market or took aboard a partner investor, bear in mind that Unison – the company, not the Trust – can already sell these assets (all but one 100% owned today) whenever and to whomever it wishes. For example, Unison Fibre appears to be up for sale.

Thankfully, as to my point #3 above, the Unison directors have taken a feeble step toward proactive fiduciary responsibility in their report to the Trust:

“The Directors are unanimous in concluding that Trust ownership remains the most appropriate form of ownership at this time but note that other forms of ownership may need to be considered if circumstances change significantly in time. In this regard, the Directors recommend that the Trust should confirm that it wishes the Directors to continue, over the next five-year period, to undertake further preliminary investigative work on sensible capital structure options required to meet any future material capital needs.”

I can imagine Chairman Hocquard on bended knee, anxiously awaiting Queen Kirton’s sword to tap his shoulder.

Given that the Trust is highly unlikely to vote itself out of existence, at the very least it should enthusiastically endorse this recommendation and ensure that it is undertaken with transparency. If the Port can drop its pants for a full-scale public review, so can Unison.

More on these issues from Free the Funds here.

I have submitted to opt to cash in the shares for a lump sum payment, which I would then invest the funds @ around 6%, producing annual interest more than twice the current annual dividend payment.

For me, it’s a no-brainer to sell the shares, as it would take 48 years of HBPCT dividends of $250 to benefit me by the $12,000 valuation mentioned. I am a Gold Card Holder and unlikely to live for another 48 years!

My understanding is that the annual dividend is paid to homeowners connected to the Unison network. The valuation of the shareholding is noted to be around $12,000 but, when a homeowner dies, that capital does not go into their deceased estate. The shareholding simply transfers to the next homeowner, so around $12,000 is lost to current shareholders’ relatives/beneficiaries.

I’m grateful to Free the Funds and Bay Buzz for bringing this possibility to my attention.

So you get all the benefit (having done nothing to earn it) while the next generation of users get nothing?

Does that sound fair to you?

I believe the Trust should be wound up.

I wholeheartedly second the above.

Sincerly

David Bosley

Glen, maybe it doesn’t sound fair, but it is exactly what the Trust Deed, a legal document, requires. The Consumers/Beneficiaries are clearly defined in the Deed and Trust Deed absolutely requires the distribution of shares directly to the “consumers of the day” and for no other purpose.

H.B.P.C.T, go find some other pile of funds to suck from , sincerely, postman red.

I too think it is time the Trust is wound up. A one off final payment is preferable and more beneficial to me than a small payment paid annually.

The shares are not yours, nor mine. They are the communities.

They were selflessly paid for by those before us, to benefit future generations – something the writer could never understand.

Stuart, I think you need to read the Trust Deed. The shares are absolutely yours. Clearly defined in the Trust Deed. It is not a community Trust. The word community does not appear in the Deed. The meaning has been distorted, disingenuously, by comments in the PwC report, and some Trustee comments in recent times.

Always difficult to remove snouts out of the public trough when they’ve been sucking our of it for years!

Anyway, if for any good reasons legal or otherwise, consumers, the name on the power account! You need Not be a property owner, are legally denied the winding up of the Trust, there would be nothing to stop any selling up in the future?? More, than most likely when queen diana & her courtiers decide to retire?

Brian, the Trust Deed may not read “community” but that is the sentiment Stuart is expressing and is a valid one IMO. If the current trust lasts through to 2072 then it should perhaps be changed to a community trust to stop this sort of asset grab. As an aside, Tom may or may not have some valid points about performance of the trustees but this is not an argument to dissolve the trust and handout to shares to existing consumers. The latter being nothing more than a money grab.

Greg, I understand the sentiment. But that is not what the Trust Deed says. The “ownership review” every 5 years creates the opportunity to distribute the shares in Unison to the Consumers, who are absolutely defined in the Deed. Are the power consumers in the Taupo and Rotorua regions part of the “community” No! Where was this concept when Unison [actually it only became Unison in the following year] bought the assets of the Taupo and Rotorua lines business in 2002. Those customers were paid out at $9.90 a share. The “inter-generational” propaganda also collapses when you consider the Taupo and Rotorua deal. Unison is a business, designed to make a profit, to be run by professional directors, and the shareholders do not need to managed by a nanny Trust.

Brian, I have no problem whatsoever with the concept of making profits. Profits which could be used to pay dividends to it’s consumers, build resilience into the system, help fund business acquisitions that make sense. This should not be confused with the idea of distributing shares to consumers and ultimately loss of control over an asset that current consumers have only played a part in building. I will be submitting to trustees to retain the ownership status quo.

Time the trust is wound up. The current trustees are acting like they are the owners not the consumers. A vote of no confidence in the trustees would make them sit and take notice.

I believe our elected Trust Members failed miserably to fully inform, the Consumers, us, who’s best interests they are supposed to mind. In particular, why were No details of the Consumer owners Options placed in any of the freebe “local community” newspapers? The miniscule amount of power consummers submissions made speaks volumes…………..yet enough was loudly trumpeted about the $240 divi funny that

May one also ask what remuneration the Trustees receive for managing said Trust?