Traditionally, the banking industry has not achieved stellar scores in popular opinion surveys measuring trust. Banks take heaps of our money, and make us struggle to get it back!

But a new villain is emerging according to a recent survey by Consumer NZ.

Supermarkets!

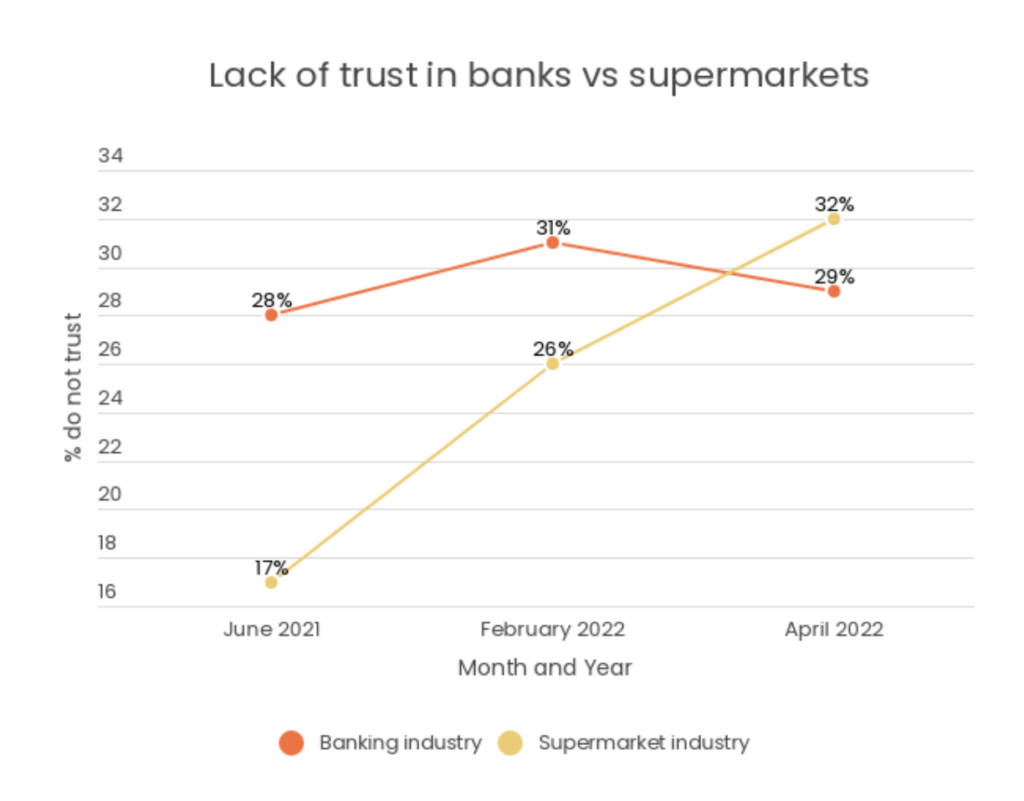

This graph shows almost a doubling of distrust in the supermarket industry over the last year, with nearly one-in-three consumers expressing distrust. According to Consumer NZ, of the 15 industries measured, supermarkets have seen the most significant decline in trust since June 2021.

And the lack of trust is sure to go lower still. What’s fueling this discontent is obviously food prices, which as of April had risen 6.4% over the previous year. Groceries went from the eighth biggest financial concern in June 2021 to third in April 2022, beaten only by rent and mortgage payments.

While the supermarket duopoly – Foodstuffs (New World, PaknSave) and Countdown – have each announced some short-term bandaid relief to their food prices, these two in-depth analyses of their plans (on Countdown, on Foodstuffs) make clear that there’s much less ‘relief’ than the supermarket rhetoric would suggest.

In the face of all this, Consumer NZ has started a petition drive – #stopthesuperprofits – calling for measures to increase competition in the supermarket sector. It has over 76,000 signatures now, and they are aiming for 200,000. Check it out here.

It is very simplistic to blame supermarkets for price increases.

The latest Producer Price Index for the first quarter 2022 shows a 3.58% increase in just 3 months.

Annualized that would equate to over 15 % per annum.

Supermarkets have no option but to pass these very high rates of product increases on to customers.

Shutting off gas availability leads to growers who need gas to heat and enhance growth with the CO2 switching to short term diesel at much greater cost.

These are the results of precipitate action by Arden on energy which is never without consequences.

Minimum wages have increased by 35 % in the last 4 years – this has flowed through to supermarkets costs.

Additional holidays and various extra time off allowances all have to be paid for by someone.

Ultimately this can only be consumers.

Shoppers can be upset but these prices increases were predictable.

…… and supermarkets still make a profit of $1million per day!

Without considering the capital employed in the business considering just the profit is meaningless- lots of businesses in NZ earn well over $ 1 million per day but they all have many billions invested.

You need to consider the return on equity and the return on capital for a fair basis of comparison of various entities returns and profitability.